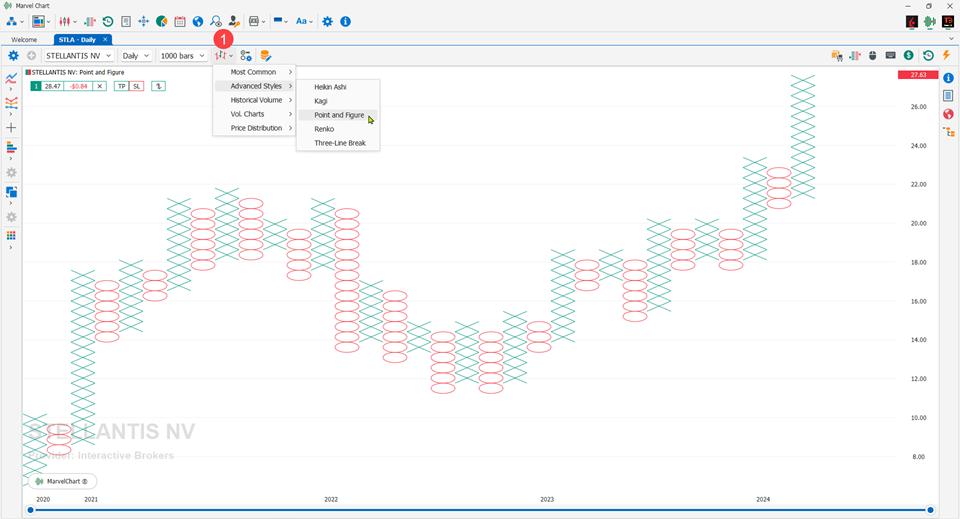

Chart Styles

The MarvelChart Chart can be drawn and set with a set of different styles, each with its own distinctive characteristics. It is possible to change the style of a Chart using the appropriate button in the Command Bar 1. The styles are grouped by categories:

Vol. Charts

Footprint

Imbalance

23 May 2025