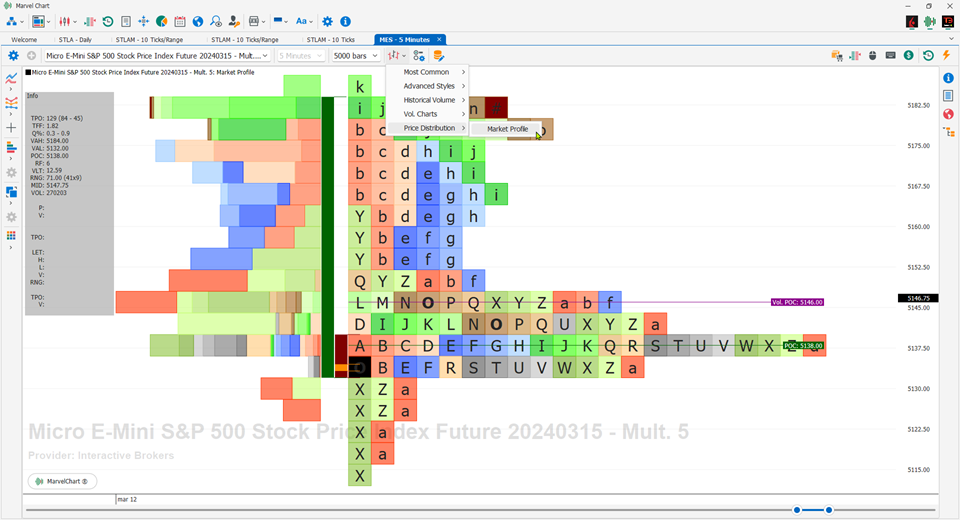

Market Profile (TPO)

Market Profile is an intra-day charting technique (price vertical, time/activity horizontal) developed by J. Peter Steidlmayer, a trader at the Chicago Board of Trade (CBOT), from about 1959 to 1985. Steidlmayer was looking for a way to determine and evaluate the value of the market as it unfolded throughout the day. The idea was to display price on a vertical axis versus time on the horizontal, and the resulting chart is generally bell-shaped: widest at mid-prices, with decreasing activity and decreased volume at the highest and lowest extreme prices. In this structure, Steidlmayer recognized the “normal” Gaussian distribution he had been introduced to in college statistics.

The Market Profile offers the possibility of viewing the price levels and volumes traded for certain time intervals, thus obtaining information on the support or resistance levels that have been created. It will also be possible to evaluate when these levels were obtained and with how many trades, thus also evaluating a measure of "strength". The blocks or letters group the prices at which the trades take place in the time selected by the user. These blocks are called Time Price Opportunities which for convenience we call TPO. The distribution of prices during the day will contain all the TPOs obtained in the selected time frame. That is, the distribution graph will have a first block (TPO) with the letter "A" which will correspond to the first price traded. This first TPO will contain all the trades that took place in the selected price range and can be followed by other TPOs with the same letter or color until the time selected in the Settings expires. At the end of this time, new blocks identified by the following letter with a different color will be added to the graph, repeating the same construction until the market closes. In an 8-hour market, if we assume that we set the timeframe to 30 minutes, we will have a distribution of blocks or letters that will be respectively: (8 0h / 30 minutes = 16) 16 different colors for 16 letters of the alphabet (from A to P). To the right of the letters, a red asterisk and the symbol # appear to indicate the Last, which at the close of trading will correspond to the Close. It is possible to display labeled horizontal lines that correspond to:

POC: shows the longest traded price in the current distribution. The value shown is the average of all the prices that make up all the blocks corresponding to the longest line;

POC Vol: shows the price at which the greatest number of trades occurred, not to be confused with the greatest number of volumes. It favors 1000 trades of 1 share rather than 1 trade of 1000 shares.

You can also display colored vertical zones that correspond to:

Initial Balance: price deviation in the first two letters of the profile (the timeframe of the letters is settable);

Opening Range: price deviation in the first 5 minutes of trading (settable);

Value Area: area that represents 70% of the number of TPOs. 70% of the TPOs are calculated starting from the POC line;

Volume Value Area: area in which 70% of the TPOs of the volumes are concentrated, calculated starting from the POC Vol line;

Initial Balance Extension 1-2-3: you can select up to 3 different vertical zones that represent the Initial Balance increased, in number of letters, by the percentage selected by the user;

Custom Lines: allows you to draw lines at set prices and names.

Finally, you can display the Volume histograms to the left or right of the distribution of the TPOs of the prices. Volume histograms are also drawn in blocks, each TPO price block has its corresponding Volume block.

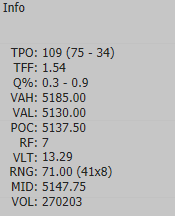

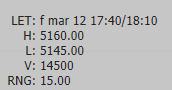

Information Panel

In the Market Profile there is an information panel that shows the characteristics of the TPO blocks where the mouse cursor is positioned. This panel is divided into several sections, separated from each other by an empty line.

First Section

TPO Date and Time;

TPO: Number of total TPO blocks in the profile, followed by the number of TPOs above the POC line and the number of TPOs below the POC line;

TFF: Trade Facilitation Factor, equal to the total number of TPOs divided by the High-Low price range of the profile. The higher the value, the weaker the trend. Profiles typically have high TFF values, and only trading days/weeks with very significant price changes have low TFF values;

Q%: Open and Close Quadrant. These values are calculated as Open/Range and Close/Range respectively. Range is the High-Low price range of the profile. Values can range from 0% (when Open or Close are equal to Low) to 100% (when Open or Close are equal to High);

VAH: Value Area High;

VAL: Value Area Low;

POC: Point of Control, which represents the most traded price in the profile, i.e. the line that contains the most blocks;

RF: Rotation Factor. For each letter in the profile, a value of +1 is calculated if its High is higher than the High of the previous letter, and a -1 if its High is lower than the High of the previous letter. In addition, a +1 is calculated if its Low is higher than the Low of the previous letter, and a -1 if its Low is lower than the Low of the previous letter. The value calculated for each letter, which can range from -2 to +2, is added to obtain the RF value of the profile;

VLT: Volatility, calculated as the average price range of the letters that make up the profile;

RNG: Price range of the profile, equal to High-Low, followed in brackets by two other values, which represent the height of the profile in blocks and the maximum width of the profile in blocks;

MID: Average price of the profile, equal to High+Low / 2;

VOL: Total volume of the profile.

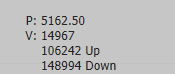

Second section

P: Price of the TPO on which the mouse cursor is positioned;

V: Volume associated with the TPO.

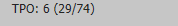

Third section

TPO: Number of blocks/TPO at the price identified by the mouse position, followed in brackets by the number of TPO above the price and the number of TPO below the price.

Fourth section

LET: Letter, represents all the letters in the profile equal to the one identified by the mouse position. In addition to the letter, the initial Date and Time of the letter is also displayed, and then the range of minimum and maximum times represented by the letter itself;

H: Maximum price of the letter;

L: Minimum price of the letter;

V: Total volume of all TPOs associated with the letter;

RNG: Price range of the letter, equal to High-Low of the letter.

Fifth section

TPO: Letter and average price of the single TPO identified by the mouse position;

V: Volume associated with the single TPO.

Source: Wikipedia

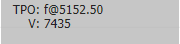

Settings

View Tab

TimeFrame: data grouping, the available choices are Daily and Weekly, indicating that each profile represents a day or a week of trading;

TPO Block Size: size of the TPO blocks, the available choices are Automatic or Manual, indicating the price excursion of each TPO block of the profile. Choosing the Auto setting, the chart automatically calculates the excursion of the TPO blocks, while choosing Manual will require setting the excursion in the following field;

Custom TPO Block Size: represents the price excursion of each TPO block of the chart, available only when “TPO Block Size” is set to Manual;

Split TPO Blocks horizontally: if active, each column of the profile will contain only one letter, otherwise the letters in the profile will be positioned in the first free position on the left, making the profiles more similar to a Gaussian distribution;

POC: enables or disables the drawing of the POCs, and chooses their color;

Volume POC: enables or disables the drawing of the Volume POCs, and chooses their color;

Value Area: enables or disables the drawing of the Value Areas, and chooses their color;

Volume Value Area: enables or disables the drawing of the Volume Value Areas, and chooses their color;

Initial Balance: enables or disables the drawing of the Initial Balance, and chooses its color;

Opening Range: enables or disables the drawing of the Opening Range, and chooses its color;

Open Symbol: chooses the color to use to draw the block corresponding to the opening of the profile;

Close Symbol: chooses the color to use to draw the block corresponding to the profile closing;

Volume Position: allows you to choose where to display the TPOs related to the Volumes. The available choices are Left (draw to the left of the price profiles), Right (draw to the right of the price profiles) and Off (does not draw the TPOs of the volumes);

Information Panel: enables or disables the drawing of the information panel related to the position of the mouse pointer.

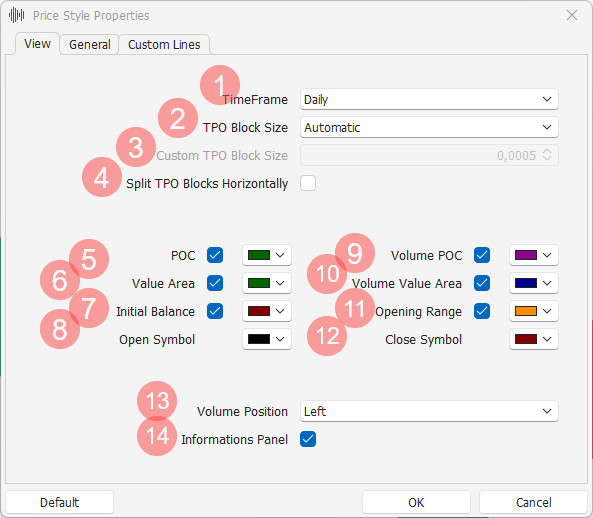

General Tab

Minutes per Letter: indicates the duration of each letter of the profiles;

First Letter Time: indicates the duration of the first letter of the profiles;

First Letter: allows you to choose which sequence of letters to use to draw the profiles;

Color for All Letters/Blocks: if active, sets a single color to use for all the letters of the profiles, otherwise the profiles will have a different color for each letter;

Draw Blocks only: always and only draws blocks, without highlighting the relative letters within the blocks themselves;

Initial Balance Extension 1-2-3: activates or deactivates extension 1, 2, or 3 of the Initial Balance, and allows you to set the color and how many letters to add to the Initial Balance, expressed as a percentage (example: if Initial Balance includes the 2 letters A and B, setting 200% the extension will include the 4 letters A, B, C and D);

Show Extensions Labels: if active, shows texts for each of the extensions of the Initial Balance active on the chart;

Opening Range: duration of the Opening Range of the profiles.

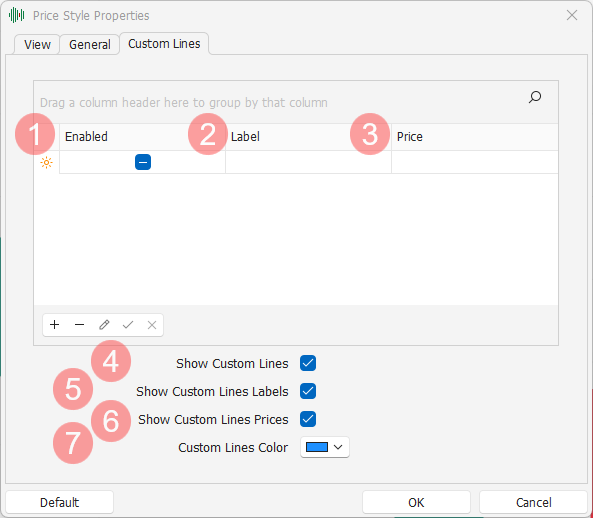

Custom Lines Tab

In the last section of the settings window you can choose which custom lines to add to the chart and how to draw them. The lines can be added or removed using the grid at the top of the tab, while the way in which they are drawn can be customized in the lower part of the tab. The columns available in the grid are:

Enabled: determines whether the line is active or off;

Label: sets what text to show next to the line on the chart;

Price: sets at what price to draw the line;

The way in which to draw the custom lines on the chart includes the items:

Show Custom Lines: if active, enables the drawing of custom lines, if off no custom line will be drawn, even if present and active in the lines grid;

Show Custom Lines Labels: if on, enables the drawing of text for each custom line, if off no text will be drawn next to the custom lines;

Show Custom Lines Prices: if on, the price of each custom line will be shown next to it on the chart;

Custom Lines Color: chooses which color to use to draw the custom lines on the chart.