Paper Trading

In Paper Trading mode no order is ever sent to the market: all orders, relating to any symbol on any connected broker, are always and in any case sent to the internal Paper Trading system of MarvelChart.

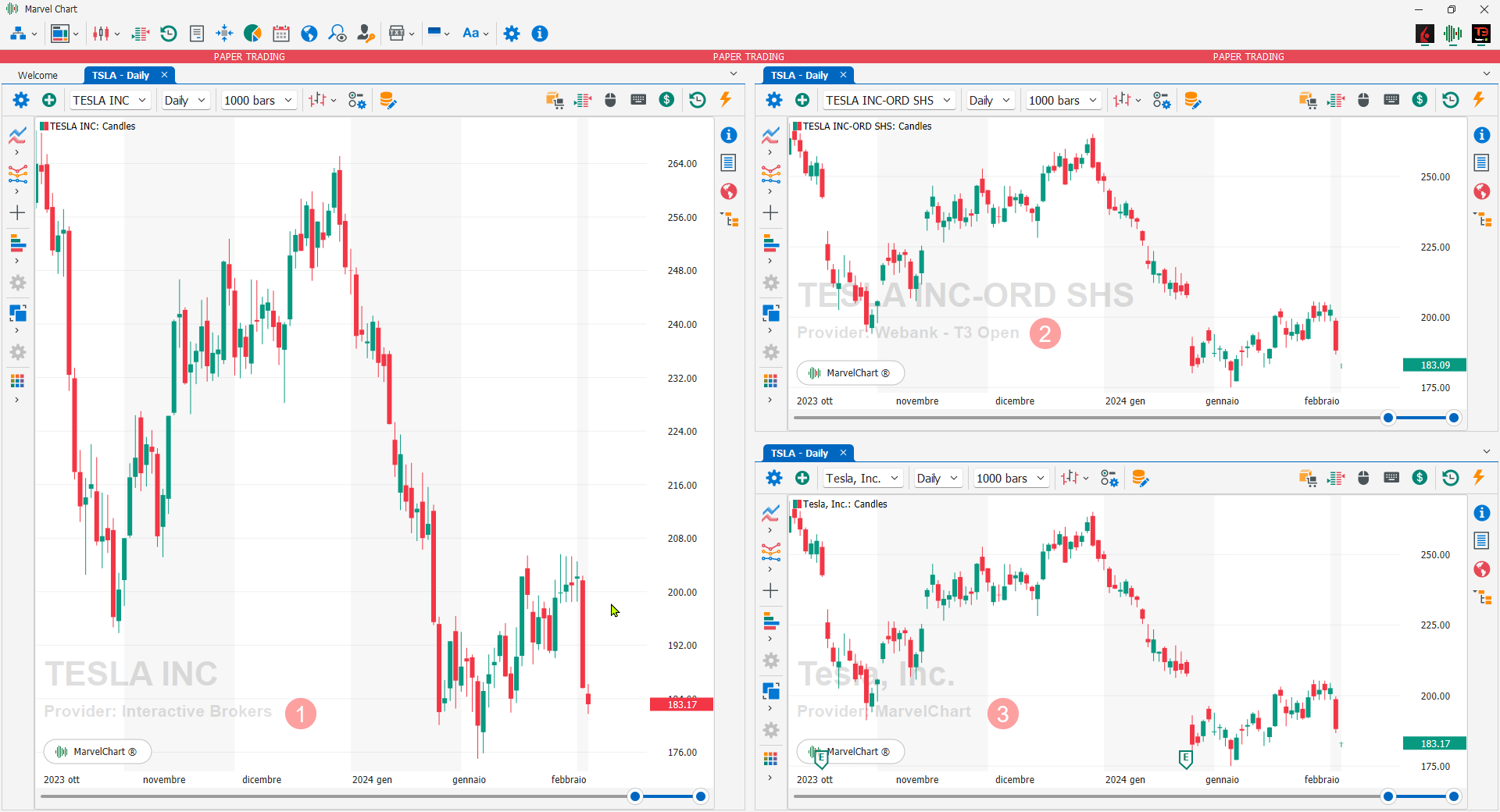

When MarvelChart is started in Paper Trading mode this is highlighted by the presence of a colored bar at the top of the window with the wording Paper Trading.

Example of MarvelChart started in Paper Trading mode

Note the three charts and the three data providers: the charts 1 and 2 are connected to the brokers Interactive Brokers and WeBank T3Open respectively (note the name next to the marker), while the chart 3 is connected to the MarvelChart datafeed. Any order created on any chart will always be sent to the MarvelChart Paper Trading system.

MarvelChart gives the user the opportunity to experience unlimited liquidity. In Paper Trading mode, you can select how to complete orders sent in the MarvelChart Paper Trading system:

Completion of Paper Trading Orders without checking the market quantities

Whether the order is sent manually or by executing a trading system, at the first price change, the quantity of assets entered is immediately counted as completely executed, without checking whether the Bid and Ask levels actually contain the quantities necessary for completion.

For example, if an order for 1000 shares was entered on a thin stock, whose Bid/Ask Volume contained a maximum of 50 shares, the trade entered will still be completed for 1000 shares at the first price change, without taking into account the quantity present on the market.

Paper Trading Order Completion by checking the quantities on the market

For a more accurate trading simulation, you can use this mode because it takes into account the quantities present in the Bid and Ask levels and the Volume of the Last price. The completion of orders may not be immediate or even completed. For example, if an order was entered for 1000 shares on a thin stock, whose Bid/Ask Volume contained a maximum of 50 shares, the trade entered will not be completed for 1000 shares but only for 50. Obviously, as other contracts with the same price pass, the order will increasingly tend to be completed. This is a behavior that is closer to what happens on the real market.